Beyond Data:

Strategic Intelligence for a

Low-Carbon Future

Objectivity & Independence

Our Advisory Services for Companies

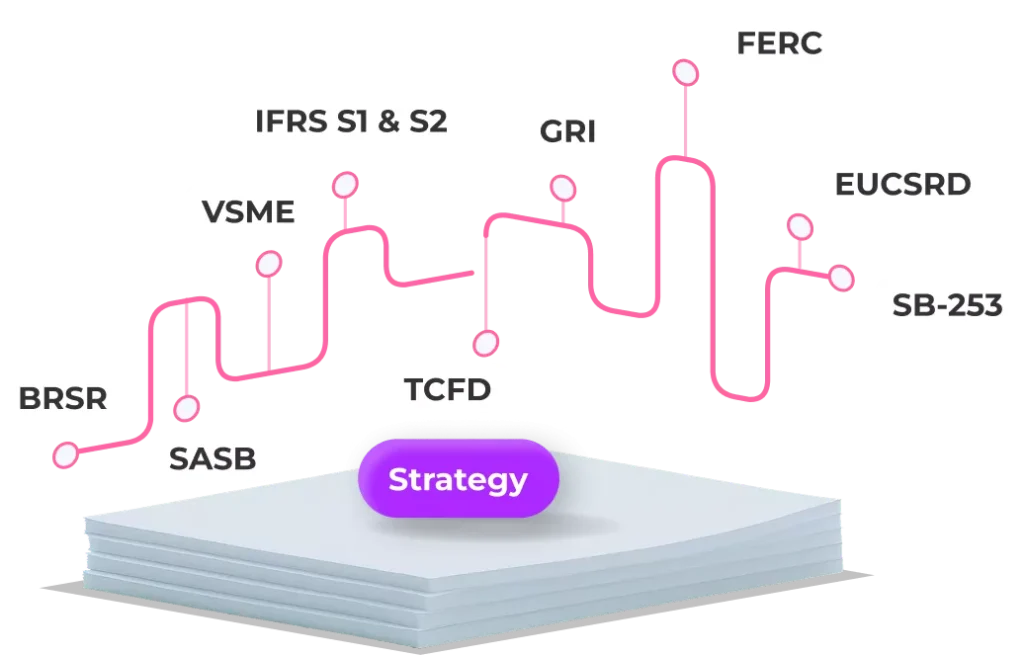

Global Regulatory Reporting & Disclosure Strategy

The landscape of sustainability reporting has shifted from voluntary to mandatory. We help you

navigate complex global and regional requirements with strategic precision.

- California Climate Mandates (SB-253 & SB-261): Strategic guidance on compliance with the Climate Corporate Data Accountability Act (Scope 1-3 emissions) and the Climate-Related Financial Risk Act.

- International Standards (IFRS S1 & S2): Aligning your financial and sustainability disclosures with the International Sustainability Standards Board (ISSB) framework.

- European Mandates (CSRD & ESRS): Detailed implementation paths for the Corporate Sustainability Reporting Directive and the underlying reporting standards.

- Framework Alignment (GRI, TCFD, SASB): Ensuring your disclosures meet the specific requirements of the Global Reporting Initiative, the Task Force on Climate-related Financial Disclosures, and the Sustainability Accounting Standards Board.

- CDP Disclosure Support: Maximizing your score and impact through high-quality annual CDP submissions.

Climate Transition Planning & SBTi Alignment

A net-zero target is only as good as the plan behind it. We help you build robust transition

roadmaps that satisfy investors, banks, and regulators.

- SBTi Target Setting: Technical support in defining and submitting Near-Term and Long-Term Science Based Targets (SBTs) to ensure your decarbonization path is 1.5°C-aligned.

- Decarbonization Roadmaps: Identifying high-impact levers within your operations and value chain (Scope 1, 2, and 3) to achieve your targets.

- Double Materiality Assessments: Identifying the sustainability matters that matter most to your business and stakeholders.

- Scenario Analysis: Assessing the financial impact of physical and transitional climate risks on your business model.

- Governance Frameworks: Setting up the internal structures and accountability needed to execute and monitor your transition.

Carbon Credit Strategy & Portfolio Management

The final mile of Net Zero requires high-integrity credits. We help you navigate the voluntary carbon market (VCM) to ensure your claims are permanent, verifiable, and scientifically sound.

- Avoidance & Reduction Credits: Advising on projects that prevent future emissions (e.g., renewable energy or forest conservation) to meet immediate mitigation goals.

- Carbon Dioxide Removal (CDR): Developing long-term strategies for high-permanence removals—such as Direct Air Capture DAC), Biochar, and Enhanced Weathering—under the Removal pillar.

- Portfolio Due Diligence: Rigorous evaluation of project durability and additionality to protect your brand from greenwashing risks.

- Market Execution: We provide referrals to our network of trusted carbon credit partners, facilitating your connection to vetted marketplaces and project developers.

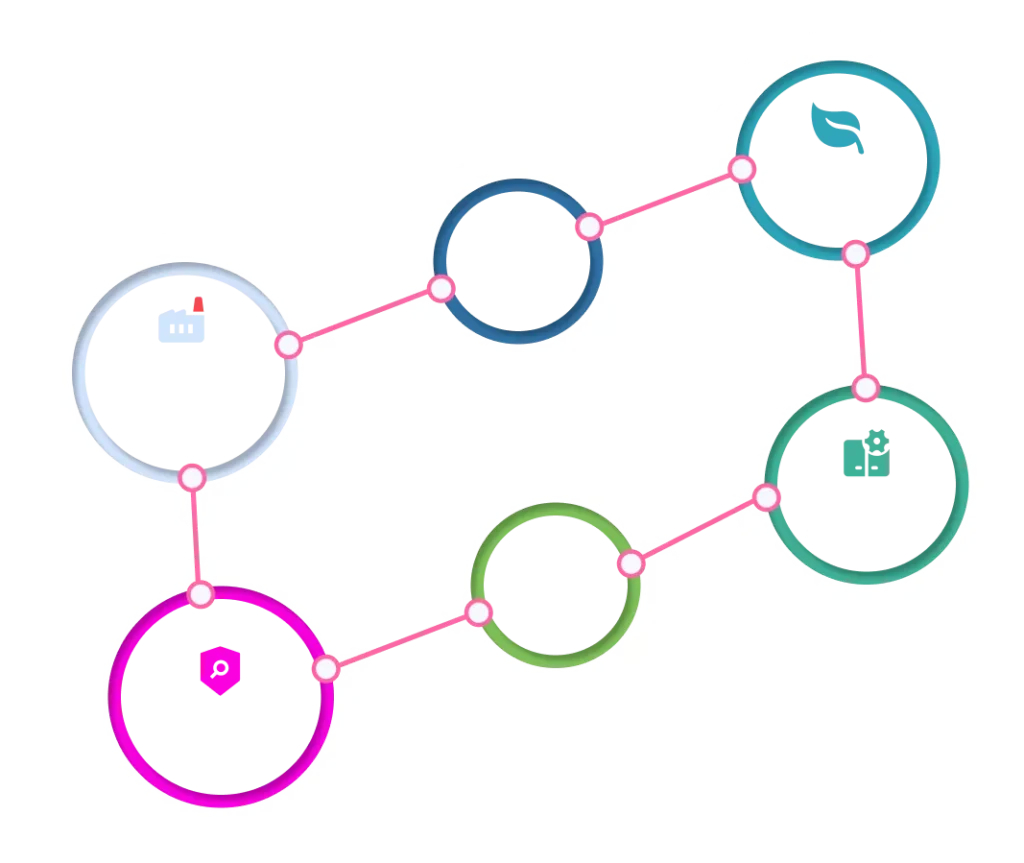

How We Partner: Our Referral Process

Requirement Mapping

We begin by defining the specific technical and functional requirements your carbon accounting or credit platform must meet, based on your industry, scale, and geographic footprint.

Expert Referrals

Based strictly on your unique requirements, we introduce you to 1–3 vetted partners from our network that represent the best fit for your specific needs.

Client Decision

You evaluate and choose the partner that aligns with your internal goals. BriskFlow AI Advisory then integrates the outputs from that partner into your overarching high-level strategy and disclosures.

Why Companies Choose BriskFlow

Agnostic Ecosystem

We work with your data, regardless of which carbon accounting tool you choose.

Expert Guidance

We stay ahead of the IFRS, EFRAG, and SBTi updates so your leadership team can focus on core operations.

Execution-Focused

We don't just provide a report; we provide a roadmap to help you achieve your climate ambitions.

Ready to Lead the Transition?